The cost of retirement in the United States varies greatly depending on where you live. Some Americans choose to retire in completely new countries, but for those who stay at home, it’s often easier to move to a different state. We’ve identified some of the cheapest states to retire in, so keep reading to discover them.

#40. Maryland

Maryland is not the cheapest state to retire in, with annual costs being an approximated $64,000. However, it is certainly cheap compared to other big states, like Hawaii and California. It has the additional benefit of affordable healthcare through the Maryland Model, which is very important for older retirees.

Beyond healthcare, Maryland also offers a mix of coastal charm and access to urban amenities. With historic towns, scenic parks, and cultural attractions, it appeals to retirees looking for variety and quality of life.

#39. Maine

Maine is another state that can be pricey depending on personal lifestyle, but it’s still a good place to consider for retirement. It has the lowest cost of living in New England, which is an expensive place to live, although it does offer an excellent quality of life for retirees.

With its charming coastal towns, peaceful natural surroundings, and low crime rates, Maine attracts those seeking a quiet, scenic retirement while still staying in the northeastern U.S.

#38. New Hampshire

New Hampshire is one state where it’s worth considering the pros and cons of retirement. Though housing costs can be high, there is no state income tax which protects retirement funds. There is also no sales tax, which helps lower overall expenses in daily life. Retirees who value financial independence often find these tax benefits appealing.

Plus, the state offers beautiful natural scenery, including mountains and lakes, along with a quiet, safe atmosphere that’s ideal for peaceful retirement living.

#37. Delaware

Delaware is a pretty affordable option for retirees looking to relocate. Though the state cost of living is a little higher than average, retirement taxes are low, as are property taxes, and there is no local sales tax. Utilities are also fairly affordable, and a little money can go a long way.

The state also offers easy access to beaches, a mild climate, and proximity to major cities like Philadelphia and Baltimore, making it both convenient and comfortable for retirees.

#36. Alaska

Alaska is a beautiful state to live in, and many older people consider it as an option for their retirement. The cost of living in Alaska varies depending on which city you live in. Kotzebue and Fairbanks offer cheaper house prices and reduced everyday expenditures, making for a more affordable lifestyle.

Additionally, Alaska has no state income or sales tax, which helps retirees stretch their budgets. Its stunning natural beauty and peaceful pace of life also add to its appeal.

#35. Vermont

Vermont is another state that can be surprisingly affordable to retire in so long as you’re aware of how to keep costs down. Though property costs can be high in certain areas, cities like Sarasota and Clearwater are typically cheaper to live in. There is also no income tax, which helps conserve funds too.

With its picturesque small towns, vibrant fall foliage, and strong local communities, Vermont offers a peaceful and scenic environment that appeals to many retirees seeking a slower pace.

#34. Montana

Montana’s cost of living varies between cities, but it is generally below average, making it a great place to retire. In fact, almost 20% of the population is aged over 65, so it’s definitely possible to live comfortably in the state on a fixed retirement income. Montana also offers wide open spaces, clean air, and a relaxed pace of life.

For retirees who enjoy nature, outdoor recreation, and tight-knit communities, it’s an appealing and affordable retirement destination.

#33. Connecticut

Connecticut is another New England state that offers good things for many retirees. Housing and utility costs can be high, though this also varies between cities, and the more rural areas offer better affordability and quality of life. Without more modest spending, it’s a comfortable place to retire.

The state also boasts excellent healthcare facilities, scenic small towns, and access to both coastal and countryside living. For retirees who value charm, culture, and convenience, Connecticut is worth considering.

#32. Colorado

Colorado offers plenty of benefits for retirees, particularly tax savings. Locals over 65 can take advantage of a $1,000 Senior Income Tax Credit, and statewide sales taxes are among the lowest in the US. Pueblo, Lamar, and Greely are just three examples of cheap Colorado cities in which to retire.

Beyond financial perks, the state is known for its stunning natural beauty, access to outdoor activities, and overall healthy lifestyle, making it a vibrant and scenic place to enjoy retirement.

#31. Illinois

Illinois has a fairly average cost of living, so it’s definitely somewhere to consider retiring. Estimated total annual expenditures are around $53,000, with average housing costs being between roughly $855 and $1,693 per month. Groceries and other essentials are also on the cheaper side in Illinois.

The state also exempts retirement income—such as Social Security and pension payments—from state taxes, offering additional savings. With a mix of small towns, vibrant cities, and access to quality healthcare, Illinois appeals to many retirees.

#30. Virginia

Virginia has some great, affordable places to retire, including Covington, Danville, and Petersburg. The state’s overall cost of living is moderate, with the average monthly costs being an approximated $300 for food and $7,000 for healthcare. As for housing, that’s typically between $1,000 and $2,000 per month depending on location.

Virginia also offers a mild climate, rich history, and easy access to both mountains and coastline, giving retirees a variety of lifestyle options in a scenic, welcoming environment.

#29. North Dakota

North Dakota is an excellent state for retirees. Its cost of living is 6% below the national US average. The state has a good economy, and housing is also cheaper than average. Retirees on a fixed income benefit from reduced essential expenses and more money for recreational activities.

Additionally, North Dakota is known for its low crime rates, friendly communities, and wide-open spaces. For those seeking a quiet, secure, and affordable retirement, it’s a great place to settle down.

#28. Minnesota

Minnesota also has a below-average cost of living, which is good for retirees. Housing costs are around 15% less than average, so there are plenty of affordable properties that can be reliably paid off with retirement savings. Utilities, clothing, and groceries are also quite affordable in Minnesota.

In addition to financial perks, the state offers excellent healthcare, beautiful natural landscapes, and a high quality of life. Its welcoming communities and four-season charm make it a comfortable place to retire.

#27. South Carolina

South Carolina is both beautiful and cheap, so it’s no wonder many people happily retire there. Though utility costs can be high, housing costs are around 23% less than the US average, which is perfect for a fixed retirement income. Grocery and clothing costs also fall on the cheaper side.

With its warm climate, charming coastal towns, and rich history, South Carolina offers retirees an inviting mix of affordability, comfort, and Southern hospitality that makes retirement feel like a getaway.

#26. Georgia

Georgia is an underrated state with a great reputation for providing a high quality of life and low cost of living. Many retirees benefit from reduced housing costs in certain cities, as well as lower taxes. The best Georgia cities to retire in for an affordable life include Albany, Augusta, and Macon.

The state also offers a mild climate, vibrant cultural attractions, and plenty of outdoor activities, making it a well-rounded choice for retirees seeking both savings and lifestyle.

#25. Utah

Utah is an incredibly cost-effective state to live in, so it’s a good choice for those anticipating retirement. The housing is good but can be a little pricey, depending on which city you live in. However, the cheaper utilities, groceries, and healthcare more than make up for that.

Utah also boasts stunning natural landscapes, including national parks and mountain ranges, which provide a serene backdrop for retirement. Its strong healthcare system and active lifestyle options are added bonuses for seniors.

#24. Michigan

Michigan is yet another cheap state to retire in, with a below-average cost of living. Despite being the most densely populated city, Detroit is actually quite affordable, with total annual expenditures of just over $46,000. Other cities, such as Jackson and Kalamazoo, are even cheaper.

The state also offers access to beautiful lakes, vibrant cultural scenes, and excellent healthcare facilities. For retirees who enjoy all four seasons and a strong sense of community, Michigan is an appealing and budget-friendly option.

#23. Wyoming

Wyoming is one of the best places to live in the Rocky Mountain states. Its cost of living is around 7% below the national average, and housing and utilities are even cheaper. Thus, retirees have more money for other essentials, like food and clothing. The state also has no income tax, which helps stretch retirement savings even further.

With wide open spaces, low population density, and stunning natural beauty, Wyoming offers peace, quiet, and affordability for those looking to retire comfortably.

#22. North Carolina

North Carolina currently ranks as one of the cheapest states to live in the US due to its below-average cost of living and flat income tax rate. Rural areas in the state, such as Lexington and Pittsboro, are usually cheaper than its urban cities, but North Carolina is an overall affordable place to retire.

In addition to its financial advantages, the state offers a mild climate, beautiful coastal and mountain regions, and a relaxed pace of life that appeals to many retirees.

#21. Wisconsin

Wisconsin requires a minimum annual budget of around $46,000 to live comfortably, so many retirees consider moving there. The biggest expense is usually housing, although that costs 11% less than the national average. Other expenditures, like utilities, don’t typically stretch the budget beyond what people can afford.

Wisconsin also offers access to quality healthcare, scenic lakes and parks, and a strong sense of community. For retirees seeking affordability with a touch of Midwest charm, Wisconsin is a solid option.

#20. Indiana

Indiana is often dismissed as an undesirable state, but it’s actually one of the best for retirees. It has some of the cheapest housing in the US, as well as affordable necessities. The average monthly cost of living is below $2,000, leaving plenty of disposable income for other purposes.

Indiana also boasts a low overall tax burden and a laid-back lifestyle. With friendly communities, quiet small towns, and easy access to healthcare, it’s a surprisingly solid choice for retirement.

#19. Nebraska

Nebraska has a cost of living that is 9% lower than the US average, giving it an edge over other states for retirees. Both housing and utilities are on the cheaper side, and healthcare and transportation typically cost less, too. That leaves more money to spend exploring Nebraska’s glorious natural beauty.

From wide-open plains to peaceful small towns, the state offers a quiet and comfortable retirement lifestyle. Its friendly communities and low crime rates also make it a welcoming place to settle.

#18. New Mexico

New Mexico is the perfect state to retire in if you want to own a good amount of land for a low price. Retirees can purchase affordable homes in decent areas, with surrounding land for privacy and reduced living costs. Daily expenses are cheaper on average, too, especially utilities.

In addition to financial benefits, New Mexico offers breathtaking desert landscapes, a mild climate, and a rich cultural history—making it an ideal choice for those seeking both affordability and beauty.

#17. Missouri

Missouri has plenty to offer to retirees, and all for a remarkably low price. Many vote it as one of the best states to retire in because of its below-average cost of living and significantly reduced housing prices. The cheapest Missouri cities to retire in include Kennett, Carthage, and Kirksville.

In addition to affordability, the state features a mix of scenic countryside and vibrant cultural hubs, offering retirees a relaxed lifestyle with access to healthcare, recreation, and community events.

#16. Oklahoma

Oklahoma is perfect for those seeking a quiet, affordable place to retire. It has one of the largest American retirement populations, thanks to its welcoming local communities and cheap housing. Transportation is also very affordable, which is a huge benefit for older retirees, and tax laws also tend to favor them.

The state’s low cost of living and access to quality healthcare make it even more appealing. Plus, its mild winters and laid-back lifestyle create a comfortable setting for retirement.

#15. Kentucky

Kentucky offers significant benefits for retired people who want to make their money go further. This state is ranked as one of the most affordable places to live in the US, with below-average-priced housing, cheap transportation, and affordable healthcare. Annual costs can be up to 20% lower than the national average.

On top of the savings, Kentucky boasts beautiful countryside, friendly small towns, and a slower pace of life—perfect for retirees looking to relax without breaking the bank.

#14. South Dakota

South Dakota is even more affordable to retire in than its neighbor, North Dakota. Its average housing prices are even lower, and there is no state income tax. In fact, South Dakota has the most retiree-friendly tax system in the country, and prices on essential items are reduced.

The state also boasts low crime rates, wide-open spaces, and a strong sense of community. With its blend of financial perks and peaceful living, South Dakota is an ideal place to retire comfortably.

#13. Kansas

Kansas is the chosen retirement destination of many Americans due to its low cost of living and friendly communities. Housing and healthcare can be accessed for a cheaper price than in most other states, especially in the state’s more affordable cities, which include Wichita, Wellington, and Pittsburg.

Kansas also offers a relaxed pace of life, low crime rates, and beautiful prairie landscapes. For retirees seeking affordability, simplicity, and a welcoming atmosphere, Kansas continues to be a top choice in the Midwest.

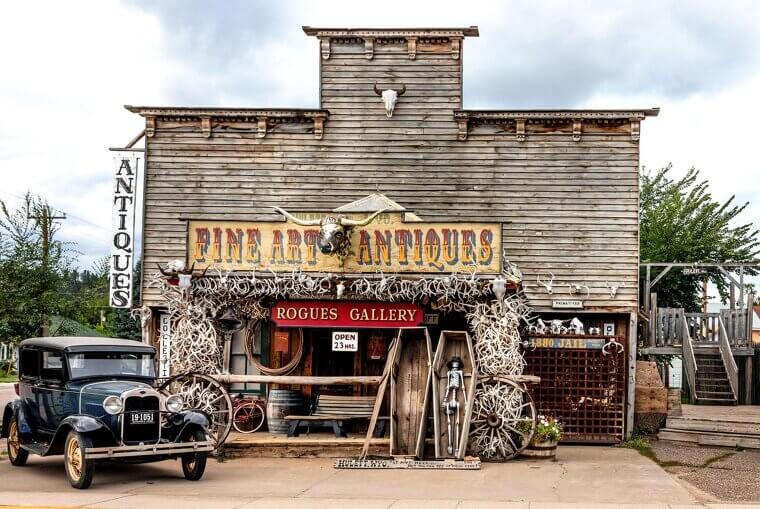

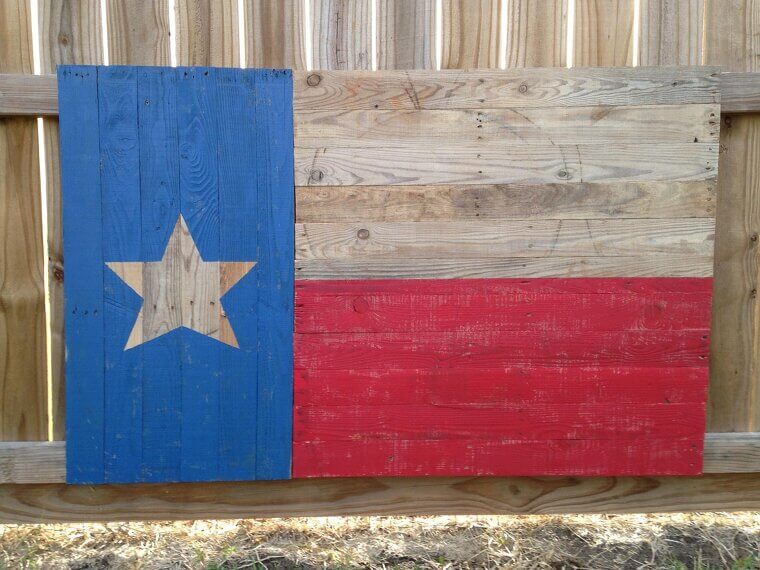

#12. Texas

Texas is a highly populated state, but it’s surprisingly affordable, particularly for those looking to retire. The state doesn’t have income tax, which protects retirement funds, and housing is generally affordable. It’s possible for retirees to enjoy the highs of Texas life without breaking the bank.

With a wide variety of cities and climates, from the Hill Country to coastal regions, retirees can find a setting that suits their lifestyle—all while benefiting from a low overall cost of living.

#11. Nevada

Nevada is a good choice for retirees because, though rental costs may be a little pricey, the costs of owning a home are usually very reasonable. Healthcare is also around 10% cheaper than the national average, and annual expenses are further brought down by affordable necessities like food.

Nevada also has no state income tax, which helps stretch retirement savings even further. With its warm climate and plenty of entertainment and outdoor options, it’s a practical yet vibrant retirement spot.

#10. Arizona

Arizona is a very budget-friendly state that retirees are starting to flock to when their home states become too expensive. Despite some rising housing costs, Arizona remains one of the best for retirees, particularly those in affordable cities like San Luis and Douglas. State tax policies also favor retired people.

In addition to its financial perks, Arizona offers abundant sunshine, dry weather, and stunning desert landscapes. The warm climate and outdoor lifestyle make it especially appealing for active retirees.

#9. Arkansas

Arkansas has enticed many seniors to retire there because of its natural beauty. However, it also offers excellent economic benefits. Income and property taxes are low, and the overall costs of buying a home and everyday necessities are far cheaper than in other states.

The state’s mild climate, abundance of outdoor recreation, and welcoming small towns make it even more attractive. For retirees seeking scenic surroundings and a low cost of living, Arkansas delivers on both fronts.

#8. Alabama

Alabama's cost of living is approximately 12% lower than the national average. For economic reasons, it currently ranks as one of the best cities to retire in, with cheaper grocery, healthcare, housing, and clothing costs than most other states. More seniors are now moving to Alabama.

The state also boasts mild winters, beautiful Gulf Coast beaches, and a slower pace of life that many retirees appreciate. Combined with its Southern hospitality, Alabama offers both savings and comfort in retirement.

#7. Ohio

Ohio is famous for its low cost of living, so it’s one of the first states many people consider retiring in. There are lots of tax-friendly perks for retirees, including no tax on Social Security income. Housing is also cheap, and plenty of recreational activities can be enjoyed for a low price.

In addition, Ohio offers access to excellent healthcare, a variety of charming small towns and cities, and four distinct seasons—making it both practical and pleasant for retirement living.

#6. Iowa

Iowa has an incredible overall cost of living at around 34% lower than the US average. This leaves local retirees with plenty of money to spend on their needs and wants. Housing prices are over 40% lower than average, too, and Supplemental Security Income payments are high.

The state also offers a peaceful, community-oriented lifestyle, with low crime rates and accessible healthcare. For retirees seeking affordability without sacrificing comfort or stability, Iowa stands out as a smart and reliable choice.

#5. Louisiana

Louisiana’s extreme weather conditions may put some seniors off, but it’s actually one of the cheapest states to retire in. It has some of the lowest property taxes in the US, as well as affordable housing, utilities, and entertainment. This low cost of living makes it possible to save more money for fun.

From its rich culture and vibrant music scene to its flavorful cuisine and historic towns, Louisiana offers retirees a lively, budget-friendly lifestyle full of Southern charm.

#4. Pennsylvania

Pennsylvania's cost of living is over 5% below the national average. Retirees can afford everything they need, including healthcare and transportation, and income tax is relatively low. The state’s cheapest cities to retire in include Cameron, Sharon, and Reading. Additionally, Pennsylvania does not tax retirement income such as Social Security benefits, pensions, or 401(k) distributions.

With its mix of charming towns, cultural attractions, and scenic countryside, the state offers an affordable and enjoyable setting for retirees seeking comfort and value.

#3. West Virginia

West Virginia’s rolling green hills and pretty towns make it the ideal place to retire. It has the lowest monthly housing costs in the entire South, as well as low property taxes and great access to affordable necessities. Social Security benefits aren’t taxed either, leaving more money in the budget.

The state also boasts a peaceful pace of life, abundant outdoor recreation, and tight-knit communities. For retirees seeking tranquility and affordability, West Virginia checks all the right boxes.

#2. Mississippi

Mississippi is one of the lowest-cost places to retire in the entire US. On average, residents spend around $32,000 per year on their essentials, including housing, food, and utilities, so they can comfortably spend their retirement funds without worrying about wasting money. It also has a generally good quality of life.

With warm weather, friendly communities, and a laid-back atmosphere, Mississippi provides retirees with both financial peace of mind and a relaxed, enjoyable lifestyle in their golden years.

#1. Tennessee

Tennessee ranks as the cheapest state to retire in because of its amazing economic benefits. It’s one of the most tax-friendly places for retirees, and housing costs are approximately 18% lower than the national average. Seniors can also enjoy affordable necessities and recreational activities.

With no state income tax, low healthcare costs, and a mild climate, Tennessee offers the perfect mix of financial freedom and comfort. From scenic mountains to lively cities, it’s an ideal place to enjoy retirement on a budget.