50. Hawaii

When many think of paradise in the U.S., Hawaii is the first state that comes to mind. It has nearly everything one might want if they were looking to retire next to the ocean. So, it's perfect, right? Well, not so fast. Hawaii actually ranks last on our list. Firstly, the state is incredibly expensive, and the cost of living is around 87% more than the national average back on the mainland.

It's so bad that many Hawaiians have been priced out of living on the island. The state's population also tips the scales at around 1.4 million, with some 282,451 over the age of 65. The state also has a sales tax of around 4%.

49. California

California used to be the dream when it came to living and retiring. The state is still attractive and offers a little something for everybody, whether you're looking for scenic beaches, chic cities, or off-the-grid living. However, it's also the second most expensive state in the U.S. to live in. It can also be pretty crowded in some areas, with a total population of around 39 million people. Of those, 4.29 million residents are over the age of 65.

California's sales tax is around 7.25% but that's chump change compared to housing and living costs in some areas. Still, it's unlikely the California dream is going to go away anytime soon.

48. Massachusetts

If you're looking into retiring on the East Coast, then Massachusetts may have crossed your mind. The state has some pretty incredible history and iconic cities, such as Boston. It's also been able to continually reinvent itself. However, it does have some drawbacks, like healthcare costs, which are some of the most expensive in the U.S., which is saying a lot. The state's population is around 6.9 million, with almost 1 million being 65 or older.

The state's sales tax is around 6.25%. If you're thinking about Massachusetts, you might also want to consider the weather, as it can get pretty chilly in the state.

47. Alaska

When it comes to the best states to retire, Alaska is at the top of many people's lists, especially if they're looking for remote wilderness. The state boasts beautiful national parks, wildlife, and idyllic seaside towns. However, it also has a pretty high cost of living, which is 32% above the national average. This is somewhat offset by low taxes. Alaska has no sales tax. The state's population stands at 736,556.

Around 110,000 of those residents are 65 or older. However, one of the main reasons the state ranks so low on our list is that it's just extremely cold, and conditions can get downright dangerous if you're not prepared.

46. New Jersey

If you've ever been to New Jersey, then you probably know that it's a popular retirement spot. It has a little something to offer for everybody, and if it doesn't have it, you can bet New York City, which is just a train ride away, does. The state has around 9.3 million residents, with 1.6 million being 65 or older. Sales tax is 6.625% in New Jersey, which isn't too bad.

However, the cost of living is pretty high in New Jersey, as are the healthcare costs, which can throw a wrench in many people's plans to retire to the Garden State.

45. Connecticut

If you're looking to retire to New England, then Connecticut probably looks like a pretty attractive option. The state has tons of beautiful small towns and fall foliage that everyone should see at least once in their lifetimes. However, it also has a cost of living that's 24% higher than the country's average. That said, retirees do have quite a few job opportunities in the state if they want to work.

There are around 3.6 million people in the state, with 590,000 being 65 or older. Its sales tax sits at 6.35%, but as we said before, property and other taxes are pretty high.

44. New York

It's hard to categorize New York since the state contains one of the largest cities in the world and is also incredibly rural outside of a couple of urban spots. However, it is worth noting that while New York City offers people nearly everything they could want in a city, the cost of living is incredibly high. In total, New York has a population of 20.2 million, with 3.5 million being 65 or older, but again, population density varies depending on where you are.

Sales tax is 4%, but depending on what area you choose, taxes can quickly start to balloon. However, there is also no shortage of things to do.

43. Rhode Island

Rhode Island packs a large punch for such a small state. For starters, it's one of the oldest states in the U.S., so there's a lot of history there. There's also a lot of coastlines, meaning there's no shortage of good seafood and picturesque towns. That said, Rhode Island's cost of living is around 22% above the national average, with a sales tax of 7%. There are 1.1 million residents, of whom only 199,100 are 65 or older.

It's definitely low on our list, but the state still has a lot to offer if you can swing the big price tag that comes with living here.

42. Washington

The Pacific Northwest should be pretty high on anyone's list of possible retirement spots. Washington, in particular, has pretty much everything you'd want out of the region, including friendly and chic mountain towns, huge expanses of forests, and, in some places, a cheap cost of living. That said, other places in the state are definitely not cheap to live in. The state has 7.8 million residents, with 1.35 million being 65 or older.

Sales tax is 6.5%, but again, taxes can vary pretty starkly depending on where you live. Still, the region is beautiful, and if you're a fan of nature and small towns, you can't really go wrong with Washington.

41. New Hampshire

New Hampshire is another popular state situated in New England. That means gorgeous fall foliage, small towns, and plenty of opportunities to enjoy nature. Sales tax is set at 0%, and it has a pretty large population of people 65 or older. In total, 1.4 million people call the state home, with 253,864 of those being seniors. It's also worth noting that New Hampshire has some great healthcare options.

That said, the cost of living is around 18% higher than the national average, but it somewhat offsets this by not having taxes on any retirement income someone might have.

40. Oregon

Oregon is situated in the Pacific Northwest, so you know you're going to get charming towns, beaches, and great hiking opportunities. However, the state does have some drawbacks. The cost of living isn't the cheapest, and it's also one of the rainiest states in the Union. Still, if you can get over that, then Oregon is a great choice, especially if you're a nature lover, hiker, kayaker, or boater.

Around 4.2 million people call Oregon home, of whom 781,200 are 65 or older. The state doesn't have any sales tax, and we should also mention that healthcare costs are around 2.6% lower than the rest of the country.

39. Maryland

Maryland lives up to its name in a lot of ways. It offers miles of coastline and tons of job opportunities for retirees. In fact, retirees in Maryland boast the second-highest household income in the U.S. However, there are caveats. The state has a high cost of living, and there are plenty of taxes, including taxes on things like estate and inheritance. Sales tax is around 6% in Maryland.

There are 6.2 million residents in Maryland, of whom 1 million are 65 or older, meaning there is no shortage of people to meet if you're a senior.

38. Colorado

Colorado has attracted a lot of retirees over the past couple of decades, and for a good reason. The state is incredibly scenic and has plenty of quaint mountain towns to settle down in. However, the influx of people has also driven up prices in the state. Housing is expensive, but the sales tax is 2.9%. The state has 5.9 million people, so it's sparsely populated for such a large state. Some 875,800 people are 65 or older.

It's also worth noting that Colorado is one of the healthiest states in the U.S., which makes sense when you consider all of the outdoor opportunities that are on offer.

37. Vermont

Vermont checks a lot of boxes if you're looking to retire to New England. It has a low population of 643,064, with 132,471 being 65 or older. Healthcare costs are relatively affordable when compared to the rest of the country. And who wouldn't want to retire to an idyllic town in the Vermont countryside? Of course, Vermont isn't perfect, and there are some things retirees should be aware of.

Vermont is actually quite high when compared to the rest of the U.S., although it is still a bit cheaper than some of the other states in New England.

36. Delaware

When most people think of Deleware, scenic small towns probably come to mind, or maybe the state's impressive fall foliage or even its place in early American history. However, when it comes to the best place to retire, Deleware is a somewhat mixed bag. On the one hand, it doesn't tax retirees nearly as much as a lot of other states in the U.S., completely forgoing taxes on Social Security benefits and sometimes pensions.

However, the cost of living is around 11% more than the national average. Around 1 million people live in the state, and 201,000 of them are 65 or older. Deleware does not have sales tax.

35. Virginia

Virginia is another state steeped in history. It offers residents plenty of chances to get out into nature or, if you prefer, catch a concert in one of its small-to-medium-sized cities. Oh, and healthcare is also surprisingly cheap here, at least relatively speaking. Around 8.6 million people call Virginia home, with 1.4 million of them being 65 or older. Sales tax sits at 5.3%. However, it might not be for everyone.

While most will find Virginia's urban areas charming, offering residents a vibrant local music scene and people both older and younger, they aren't as big and bustling as some may want. That said, Washington, D.C., isn't that far of a drive.

34. Utah

When most people think of Utah, high taxes usually isn't the first image that comes to mind. However, for whatever reason, Utah has some pretty hefty taxes. According to WalletHub, Utah has the 15th highest tax burden in the U.S. Its sales tax is average at around 6.1%. However, residents do have access to some great healthcare and amazing national parks. The terrain is also varied, and the state has both forests and a desert.

Some 2.7 million people live in Utah, 315,900 of whom are 65 or older. The state is third in terms of the number of national parks, behind only California and Alaska.

33. Nevada

A lot of retirees end up settling down in Nevada. The state is pretty generous when it comes to taxes and doesn't even have an income tax. That may be because the state makes a lot of revenue off casinos (Las Vegas is in Nevada). Around 2.9 million people live in Nevada. Of those, 478,500 people are 65 or older, which is a pretty large percentage. Sales tax is around 6.85%.

However, Nevada is mostly desert, meaning you have to really enjoy the landscape because there isn't much else. Temperatures can also get pretty warm in the summer and cold in the winter.

32. Minnesota

When most people think of Minnesota, they might think of the state's harsh winters. However, it's also a state filled with opportunities to get outdoors. In fact, it ranks number one when it comes to retiree health. That might also be because it has a really good healthcare system that costs patients less than if they were in a lot of other states. Some 5.7 million people call Minnesota home, of which 950,000 are 65 or older.

Sales tax is 6.875%, but we should mention that the state helps keep healthcare costs down through different taxes. The state has both income and Social Security taxes.

31. South Dakota

The Dakotas are some of the most sparsely populated states in the U.S. South Dakota, despite being large in terms of land size, only has a population of about 909,824, of whom 159,219 are 65 or older. South Dakota also has really low taxes, which might help explain why it's home to so many retirees. Sales tax sits at 4.5%. In addition, there are tons of opportunities to get outdoors.

However, there is a drawback, and that's the state's dreaded winters. It might also not be the best place for those looking for larger cities, though the cities it does have are surprisingly vibrant.

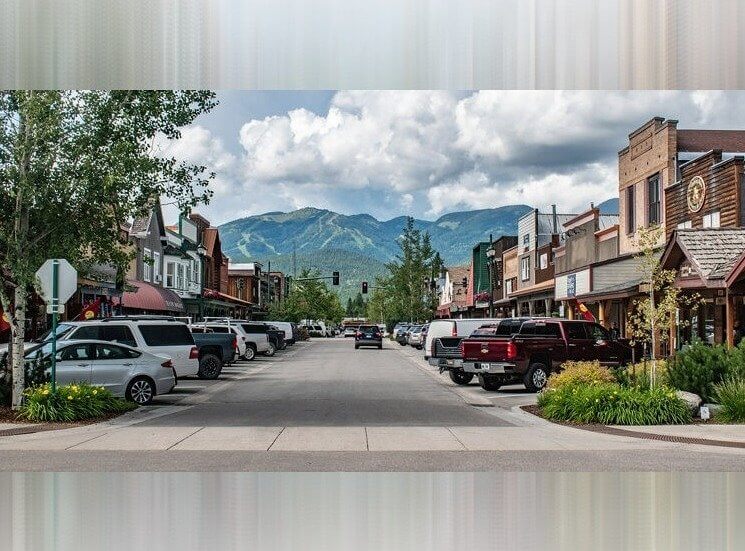

30. Montana

Montana is a nature lover's paradise, boasting some of the best mountain landscapes in the U.S., as well as some of the nation's most iconic national parks. That said, it doesn't have as many large or iconic cities as some of its neighbors. If you're looking for a life in the countryside, then that might not be a dealbreaker for you. However, the state is also known for its high taxes.

Montana is pretty sparsely populated, with only around 1 million residents, 196,000 of whom are 65 or older. It doesn't have a sales tax, but again, it does have other taxes that are pretty hefty.

29. Arizona

Over the past couple of decades, Arizona has cemented itself as one of the top states for retirees. It's had a huge influx of people from out of state. The population of Arizona is around 7.5 million people, with 1.4 million of them being 65 or older. Many people in the state are outdoorsy, which is to be expected with the warm weather and beautiful scenery on offer. Not to mention, Arizona has the Grand Canyon.

Sales tax is 5.6%, but we should mention that retiree income is around 10% lower than the national average. Also, if you're not a fan of the desert landscape, then Arizona might not be for you.

28. North Dakota

"Vibrant" might not be the first thing that comes to mind when you think about North Dakota, but cities such as Fargo regularly defy expectations and rank pretty high on travel and food lists. The state also offers residents a lot to do out of the city. Like its neighbor to the south, North Dakota is pretty sparsely populated with 780,588 residents, 125,674 of whom are 65 or older.

Sales tax is 5%, and other taxes are also pretty low. However, like every other state in the area, winters can be pretty harsh, and its cities aren't the largest if you're just looking for a big metropolitan.

27. Florida

If most people were asked to name a state they most closely associated with the word "retiree," many would say Florida. The state's beaches have drawn in more retirees than some states have people. However, that has been a double-edged sword. Taxes remain relatively low, with a sales tax of 6%. However, few small beach towns still exist, and most places see huge influxes of tourists during the summer months. Also, all the condos look identical.

That said, the state is pretty big, and it's still possible to find old Florida vibes if you know where to look. The southern portion of the state also offers retirees a more Caribbean vibe. Florida's population is around 22.2 million, with 4.7 million being 65 or older.

26. Wyoming

Wyoming is known for its beautiful landscape and national parks. There are enough outdoor activities here to keep even the most hardcore hiker occupied for a while. However, Wyoming's population sits at around 581,381. That makes the state the least populated in the U.S., ranking higher than both Alaska and much smaller Vermont. But that may just be what some people are looking for. Sales tax in the state is 4%.

Wyoming also doesn't tax income. So, if vast expanses of wilderness, mountains, and big blue sky are what you're looking for, then Wyoming isn't a bad choice at all.

25. Maine

Maine ranks higher than some of its New England neighbors for a couple of reasons. However, it mainly comes down to economics. The cost of living in the state is 2% below the national average and much cheaper than some of its neighbors. Maine does tax retirement income, but not Social Security. Of course, it also offers world-famous seafood and some of the most charming seaside towns in the U.S.

Around 1.4 million people call Maine home, with 305,200 being 65 or older. Sales tax is 5.5%, but we should mention that retirement income tends to be a bit lower here than in other places.

24. Pennsylvania

Pennsylvania has a lot of things going for it. For starters, Forbes named Pittsburg as its top city for retirees. There's plenty to do whether you're looking for a big city, a small town, or a place in a more rural setting. The state's population is around 13 million, with 2.3 people 65 or older. Healthcare in the state is also pretty good. So, it's the perfect retirement destination, right? Well, there are some question marks.

Mainly, the state is in a bit of a bind financially, and many are predicting that it will have to raise taxes in the near future. Just exactly what they'll raise taxes on is still an open question. Sales tax sits at 6%.

23. Wisconsin

Let's be honest: when most people think of Wisconsin, the first thing they think of is probably related to cheese, cows, or farmland. The state does have those things, and personally, we love all three. However, it's also home to some pretty large cities, such as Green Bay, which is the home of the Green Bay Packers, and Milwaukee, which is the birthplace of Harley Davidson. It also offers decent tax breaks for those with a lower-income background.

However, depending on where you live, the cost of living can get pretty high in Wisconsin. Healthcare costs are also higher than in most other states. The state has a population of 5.9 million, with 1.1 million being 65 or older. Sales tax is 5%.

22. Illinois

Illinois is similar to New York in that its largest city, in this case, Chicago, sometimes takes all the limelight from the rest of the state. While Chicago is great, the state also has a cost of living that's 4% lower than the national average. The state's total population is 12.6 million, with 2.1 being 65 or older, and the sales tax is set at 6.25%. Now, that's the good.

In terms of things to keep in mind, the state is similar to Pennsylvania in that some suspect it's going to run up against some financial issues in the not-so-distant future.

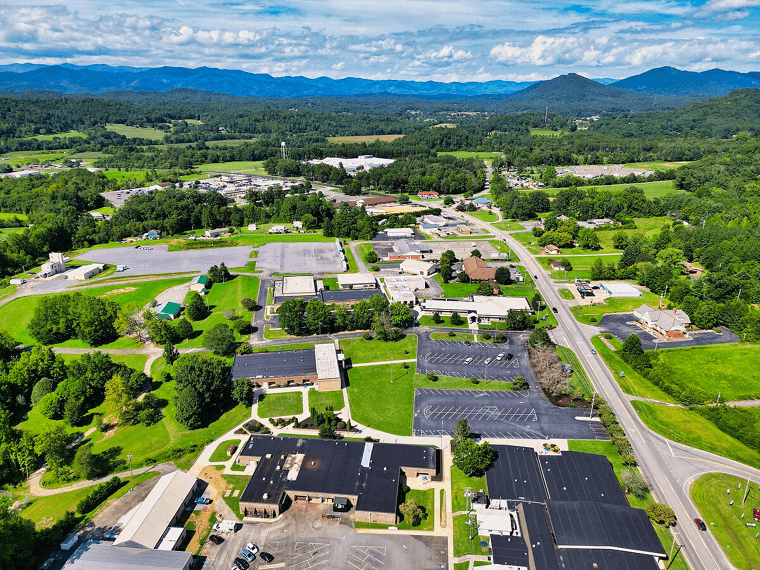

21. Idaho

Idaho is a great choice for those looking for a lot of opportunities to get outside and enjoy nature. This makes sense, considering it's situated between the states of Washington, Oregon, Montana, and Wyoming. The state has a population of 1.9 million people, of whom 315,400 are 65 or older. Sales tax is 6%, and the cost of living is 5% lower than the national average, making it attractive economically.

The main downside for most might be that its biggest city is Boise, which isn't small but also isn't as large or bustling as some people might like.

20. New Mexico

Like Arizona, New Mexico has emerged as a retiree hotspot in the Southwest over the past couple of decades. There must be something about the peaceful desert vibes and sunny weather. The state is home to some pretty vibrant cities, as well as locations that are incredibly remote. After all, this is the state where the first atomic bomb was tested. Today, New Mexico's population sits at 2.1 million, with 388,500 residents 65 or older.

Sales tax is 5%, and the cost of living is lower than the national average, although the state does have some odd tax laws that should be researched if you plan on moving there.

19. North Carolina

North Carolina has a little bit of something for everybody. The state has mountains, an extensive coastline, small towns, big cities, and great weather. In terms of population, there are around 10.7 million people within the state's borders, of whom 1.8 million are 65 or older. Sales tax is 4.75%, and the cost of living is relatively low when compared to a lot of other places (depending on where you're at). However, there are also some drawbacks.

Average incomes aren't the highest in the state, so it could be difficult to make a lot of money working if you plan on keeping yourself busy after retirement.

18. South Carolina

South Carolina barely edges out its neighbor to the north on our list. However, like its neighbor, it has great weather and plenty of opportunities to get outdoors no matter what you're looking for. Its cities, such as Charleston, also regularly rank pretty high on food and travel lists. It doesn't hurt that the state's cost of living is around 7% lower than the nation's average. Sales tax is around 6%.

The state's population is around 5.3 million people, with 985,500 being 65 or older. Summers can get pretty humid, but that applies to pretty much every state in the region. Also, incomes aren't the highest in South Carolina.

17. Georgia

Georgia, like South Carolina, has something for pretty much everyone. However, it also has a huge urban center in Atlanta. Around 10.9 million people call Georgia home, with 1.6 million of them being 65 or older. Like many other states in the South, Georgia has seen a huge influx of people in recent years, so cities can be pretty crowded here. Sales tax sits at 4%, and taxes, in general, are usually pretty low.

Summers can be pretty hot and humid, but again, that's every state in the region, and there are plenty of rivers and kayaking opportunities to take advantage of most of the year.

16. Missouri

Missouri has a pretty fascinating history and sits between the American South and the Midwest. Its population is around 6.2 million people, of whom 1.1 million are 65 or older. Sales tax is 4.225%, which isn't bad, but the state's cost of living is around 10% lower than the nation's average. There are also plenty of outdoor activities to take advantage of, as well as the city of St. Loius if you're looking for big-city vibes.

However, like a lot of other states with really low costs of living, incomes aren't super high in Missouri. Healthcare in the state also doesn't rank very high compared to others.

15. Texas

Texas is another state that has seen tons of people move in from out of state in recent years. Luckily, it's also a large state filled with plenty of different cities and more rural areas. The cost of living is 10% lower than the national average, and the sales tax is 6.25%, but the state, in general, is known for its low tax rates. Around 30 million people live in Texas, with 3.9 million being 65 or older.

Texas ranks pretty high on our list because there are so many things for everyone. The state has a large coastline and different cities that all have a unique identity and aspects of both the South and Southwest.

14. Louisiana

It really shouldn't be a surprise that Louisiana is so high on our list. The state boasts some of the best nature, food, and music in the U.S., coupled with low taxes. If you're looking for more of a city vibe, then it's hard to beat New Orleans. Around 4.6 million people live here, with 759,000 being 65 or older. Sales tax is 4.45%, which isn't bad, but like Texas, other taxes tend to be pretty low as well.

Incomes are generally pretty low in Louisiana, but so is the cost of living. There are also tons of fishing villages where residents can find amazing seafood for cheap.

13. Nebraska

Nebraska might not be on your list of top places to retire, but the state probably should be. To start with, the cost of living is incredibly low at 12% below the nation's average. And while you might not think about cities when you think of Nebraska, Omaha has around 1.3 million people. That's a pretty large population, especially when you consider that the state only has 2 million people living there. Around 328,000 residents are 65 or older.

Sales tax is 5.5%, but we should mention that the state does tax Social Security and retirees' income. Still, taxes, in general, are usually pretty low in Nebraska.

12. Tennessee

Tennessee scores so high on our list for a couple of different reasons. For starters, the cost of living is pretty cheap, as 12% below the nation's average. In addition, despite the state having some pretty large cities in Nashville and Memphis, real estate is still pretty affordable in most places. If you're looking for smaller cities, then Chattanooga regularly scores pretty high on lists involving the best places to live.

Tennessee has around 7.1 million people, of whom 1.2 million are 65 or older. However, sales tax is a bit high at 7.1%, but other taxes tend to be pretty low. The state also has surprisingly affordable healthcare.

11. Ohio

Ohio is similar to other Midwestern states in that it contains both large cities, including Columbus, Cincinnati, and Cleveland, as well as more rural areas. However, there are a couple of things that set it apart from its neighbors in the region. The state has a really low cost of living on average, as well as no Social Security tax. That said, incomes aren't the highest, so it might take some research to balance out your budget.

Ohio has a population of 11 million, thanks to its many cities, as well as 2.1 million people who are 65 or older. Sales tax in the state sits at 5.75%.

10. Michigan

Michigan comes with a caveat. The state ranks pretty high in part because of its low cost of living (12% lower than the national average) and generally low taxes. However, most expect the state to make some changes in regard to its taxes pretty soon in the future. That said, it still has nearly everything you could want. There are iconic cities, as well as vast stretches of wilderness.

It also sits on the Great Lakes, meaning there are plenty of opportunities to hit the water. Around 10.3 million people call Michigan home, of whom 1.9 million are 65 or older. Sales tax is 6%.

9. Iowa

When most people think of Iowa, they probably think of rows and rows of corn. However, not many know that UNESCO designated Iowa City as a "City of Literature" for its pioneering efforts in teaching creative writing. That placed it in an elite club that includes cities like Edinburgh and Dublin. In terms of taxes, Iowa doesn't have a Social Security tax, but it does still tax income. Sales tax is 6%.

Most of the cities in Iowa rank pretty well when gauged for retirement potential, and obviously, there are still more rural areas that offer more chances to experience nature.

8. Alabama

Alabama is another Southern state that has seen people from elsewhere move to in recent years. Living here will see your cost of living drop to 13% below the nation's average. Taxes tend to be pretty low in most parts, and sales tax is 4%. In addition, the state has plenty to do in terms of nature, as well as larger urban areas such as Birmingham, Huntsville, and Mobile.

However, like other states along the Gulf Coast, Alabama is prone to some pretty extreme weather in the form of hurricanes, tornadoes, and large summer showers. It can also be pretty humid in the summer.

7. Kansas

Kansas finally seems to be getting its due. However, many suspect the low taxes that in part make it so attractive may be raised in the near future. Still, Kansas is home to Kansas City and Wichita, as well as other smaller but just as charming towns. There's also a ton of state parks to choose from if you'd like to get away from the city for a little while.

Around 2.9 million people live in Kansas, and around 484,300 of them are 65 or older. The state's sales tax is 6.5%, but as we said, look for other taxes to rise.

6. Kentucky

Kentucky boasts one of the lowest costs of living in the U.S. at 14% below average. If you've ever been there or seen pictures, then you also know that it's filled with quite small towns and amazing nature. However, it also has high healthcare costs, and incomes tend to be pretty low on average. Still, there are plenty of reasons to choose Kentucky if you're looking for a place to retire.

Sales tax in the state is 6%, and the population sits at around 4.5 million, with 796,650 aged 65 or older. Oh, and we should note that while there aren't any large cities in Kentucky, the cities that are there are pretty vibrant.

5. Mississippi

Mississippi is another state with a really low cost of living. The southern portion of the state is filled with fishing villages and scenic drives, while the Mississippi Delta offers travelers and residents a chance to see the birthplace of blues and rock-n-roll ( a title also claimed by Memphis.) Taxes are also among the lowest in the nation here. However, incomes tend to be equally low, especially among seniors.

The state has around 2.9 million residents, of whom 487,200 are 65 or older. Surprisingly, sales tax is a bit high at 7%, but as we said, other taxes tend to be low.

4. Indiana

Indiana is somewhat of a mixed bag. On the one hand, the state tends not to shy away from taxes of any kind (sales tax sits at 7%). However, the cost of living is 15% lower than the national average. It also offers a pretty big city in Indianapolis, as well as plenty of more rural areas and towns for a slower pace of life if that's what you're looking for.

The state is home to 6.6 million people, and 1.1 million of them are 65 or older. We should also mention that, like other states in the Midwest, Indiana usually sees pretty cold winters.

3. Oklahoma

Oklahoma ranks pretty high in most metrics. In addition to its iconic countryside and history, it's also home to vibrant cities. Not to mention, the tax rate is low, and sales tax sits at 4.5%. However, like some of the other states with a low cost of living and meager taxes, healthcare isn't the best, and seniors may find special care lacking, especially when it comes to nursing homes.

Still, the weather isn't bad, and with a population of around 4 million, including 648,000 seniors, it won't be as hard to meet people as it might be in some other Western states.

2. West Virginia

If you've ever wanted to sing "Country Roads" and then actually drive home to West Virginia, then now might be your chance. The cost of living here is 17% lower than the national average. The state is also filled to the brim with plenty of natural areas and quaint mountain towns. Unfortunately, incomes tend to be on the lower side of the scale here, and unemployment has been a problem in recent years.

Also, healthcare isn't the greatest, and depending on the source, the state often ranks at or near the bottom of the list. The state's population is around 1.8 million, with 372,600 seniors and a 6% sales tax.

1. Arkansas

Arkansas is our unlikely number one on this list. It combines some of the best aspects of the top 10. It's one of the best places in the U.S. in terms of outdoor opportunities, and while it doesn't have any huge cities, it does have some medium-sized cities that are full of life and offer residents pretty much anything you could want. The cost of living is also 17% lower than most other places in the U.S.

Only 3.1 million people live in the state, of whom 542,500 are 65 or older. However, it's not perfect, as the sales tax is 6.5%, and the income tax isn't low.